Trending

6 Executive Search Trends from Top Finance Recruiters

/in Equity & Compensation, Featured on Home, Talent/by hannah@fcc.vc5 Considerations to Successfully Scale Global Benefits

/in Featured on Home, I Need to Retain my Top Performers, I'm Looking for Strategic Planning Tips, Talent, Trending/by thecircle@fcc.vc4 Considerations To Craft Your Company’s Equity Strategy

/in Developing Your Team, Equity & Compensation, Featured on Home, I Need to Retain my Top Performers, Secondary Liquidity, Talent, Trending/by thecircle@fcc.vcShare this entry

SUBSCRIBE

Playing Chess, Not Checkers: Strategies to Build a Successful Equity Program

How to prioritize flexibility, educate employees about their equity value, and plan for liquidity events where employees can cash in.

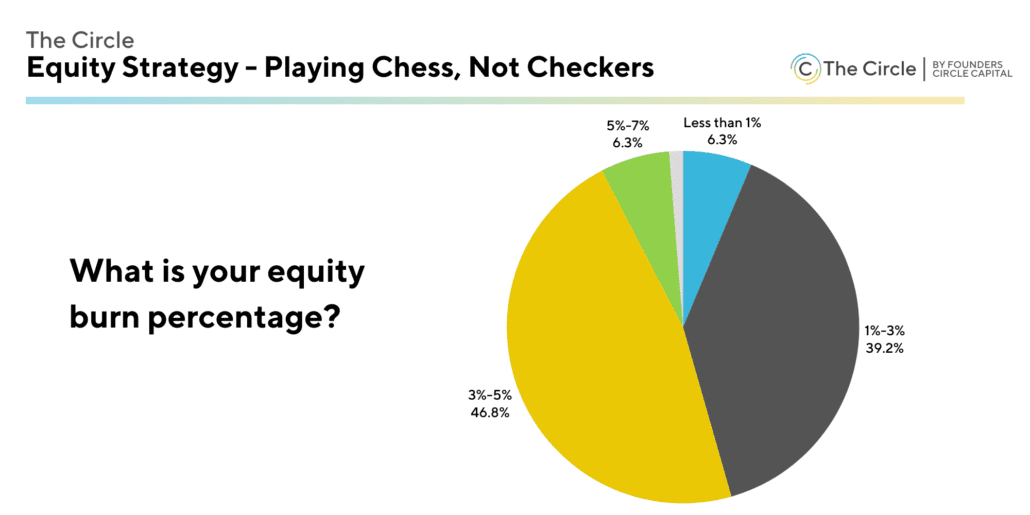

Managing equity burn is a critical challenge as your organization scales, requiring a balance between rewarding talent and maintaining shareholder value. In a survey of finance and people team leaders in The Circle, 40% of respondents said that their company’s equity burn was between 1% and 3%. Meanwhile, another 47% of respondents said their company’s equity burn was between 3% and 5%.

In a conversation with The Circle, Ashish Raina (Compensation and HR Consultant at Optimize Talent, LLC), Shawn Murphy (Managing Director, Head of Private Markets at Morgan Stanley at Work), and experienced Chief People Officer Anand Mehta discuss four ways to play the strategic long game, prioritize flexibility, educate employees about their equity value, and plan for liquidity events where employees can cash in.

♟️Play the Long Game: Ensure Your Equity Plan Ties with Your Business Strategy

In chess, most people assume that grandmasters always know all the moves to make ahead of time. The reality is that they are actually more positional and understand the structure of the game better than others. The same can be true for a Chief Financial and People Officer: it’s not only about having a compelling equity program, it’s about having that program tie into the company’s structure and strategy. Your equity offerings must align with your company’s business direction, and be flexible enough to evolve with any company changes over time.

Some key questions Shawn encourages companies to ask themselves that will impact their equity strategy include:

- How many people will you be looking to recruit over the next several years? New hire grants tend to be the largest source of equity burn.

- What type of employees are you looking to attract? People later in their careers tend to value up-front cash compensation more than stock. However, early-career employees tend to view equity more favorably and want to join growth-stage start-ups.

- How long do you intend to stay private? Private companies used to go public in 5-6 years, but now that number has doubled.

- If you stay private longer, will you have any liquidity events along the way? Most employees are not in a position to go 10+ years without cashing in some of their grants so providing liquidity is vital as companies stay private longer.

- Are you planning to expand globally, or not? This will impact the equity program structure and has tax implications.

The answers will influence the type of equity culture your company wants to build. A company that provides equity can create an “ownership over outcomes” mentality where employee performance — and their financial upside — is tied to the organization’s long-term success.

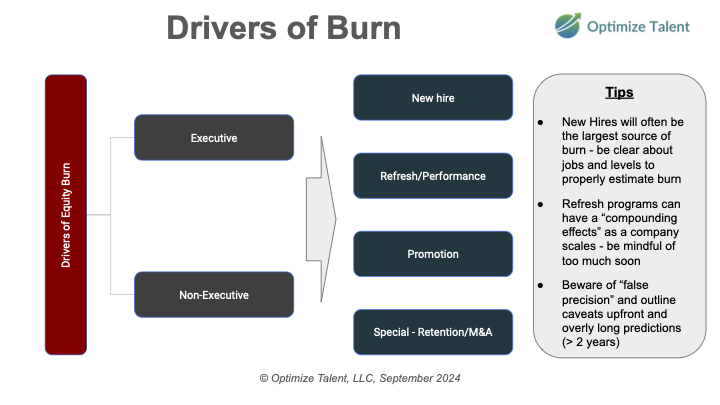

Ashish shared the largest drivers of equity burn and offered tips on how to counteract each.

♟️Keep Your Options Open: Prioritize Flexibility

In a game of chess, flexibility is a competitive advantage. The same is true for building an equity program — you don’t want to create a plan that follows only one growth trajectory or exit outcome. Consider what will happen if your company intends to go public, but does not ultimately do it. Or your company created a plan around operating in only one country, and then you can expand globally. You never want to feel forced into a decision.

Flexibility is especially important at scale when a single decision can have an outsized impact on the company. Ashish points to equity grant refreshes as an example of something that can have a compounding effect as a company scales. Decisions have to be made about what to grant and to whom — and it’s not always equal.

“The biggest strategic trade-off you might run into — and it isn’t obvious when you set up your program — is evaluating grants based on retention versus performance. You are not going to be able to retain everyone and also reward high performers at scale.”

– Ashish Raina, Compensation and HR Consultant, Optimize Talent, LLC

There might come a time in your company’s growth when you decide to change your equity grant packages and allocate more for high performers than long-term employees. Perhaps your company chooses to offer a potential key senior leader hire more equity than usual to bring them onto the team. Or your organization might decrease new hire stock grants because your company now pays market-rate salaries.

The number of trade-offs you might make is endless, but the path forward is clear: Build the strategy for the future and allow for optionality within the plan.

♟️ Strategy and Protection: Help Employees Realize the Full Value of Equity

Just like in chess, where advancing a pawn too quickly without protection can lead to loss, employees need to understand the importance of staying informed, asking questions, and protecting their equity by understanding vesting schedules, tax implications, and the long-term growth of the company.

According to Morgan Stanley at Work’s latest workplace trends report, 43% of participants said equity was a big reason they joined their company. Perhaps more importantly, that also indicates that more than half of employees don’t have a strong sense of the value of equity. This is, in part, because equity is complicated, especially at a private growth-stage company where the stock price isn’t publicly listed.

Having a good equity story is table stakes, but more than a story is needed. Shawn encourages practicing ongoing education and she makes an important distinction — strive for helping employees engage with their equity, rather than simply communicating information to them in a one-way conversation.

“My viewpoint is that your equity compensation strategy should focus less on giving equity to those who value it,and instead ensure all employees understand the value of equity.”

– Shawn Murphy, Managing Director, Head of Private Markets, Morgan Stanley at Work

Leaders might consider a full-on education program tailored to different segments of employees: Are they nearing retirement age? Have they just graduated from university? Are they about to start a family and enter into a new financial situation? By educating employees based on their individual questions and life phases, you can begin to help them see equity from a more holistic view along their wealth journey and show how it can impact their lives.

♟️The Ultimate End Game: All Roads Lead to Liquidity

Equity is only really valuable when it can be converted to cash, so everything — the strategy, optionality, and engagement — ties into how a company will provide liquidity. This is where things can get more complicated. (Back to optionality: What happens if a liquidity event doesn’t happen?)

While an IPO is a cause for celebration and a hard-earned accomplishment after years of work, Anand notes it can also be highly disruptive to an organization.

“Stock prices can be volatile after an IPO. Even a great company like Google had its stock price crash the year after it went public. All of your employees see their wealth go up and down and they can’t do anything about it right away because they are in a lock up period.”

– Anand Mehta, Chief People Officer

Here are five questions you can start to ask yourselves now, even if your company’s planned exit is still years away:

- For companies that stay private longer, will you offer any liquidity events — tender offers, secondary markets — before an exit outcome? If an exit outcome is further on the horizon, would you allow your employees to tender, say, 10% of their holdings to take some money off the table, while still keeping a meaningful ownership stake?

- What is your financial education strategy to support employees on their journey to financial health, including equity 101, retirement planning, etc.?

- Should you grant RSUs instead of stock options, to make it easier for employees to understand the equity value and convert them to cash?

- Have you given consideration to executives who might need to pay millions on stock options, but don’t have the cash?

- Have you polled employees to take a pulse of their feelings about their equity and overall financial health? Examples include: If we were to do a tender offer, would you participate? Do you see this as valuable? Would you sell some shares because you need the money? Or do you believe the value is capping out?

The Takeaway:

The topic of equity continues to be one of the most popular among members of The Circle — and for good reason. It can help create that ownership over outcome employee mentality that leads to long-term company success.

But for finance and people team leaders, it can be hard to balance costs with equity burn and employee expectations. The teams that craft a flexible equity strategy can ensure their program supports sustainable growth and team engagement.

Apply to join The Circle to participate in conversations like this one within a private leadership community of CXOs.

Related Blog Posts

6 Executive Search Trends from Top Finance Recruiters

5 Considerations to Successfully Scale Global Benefits