Qualified Small Business Stock (QSBS) Tax Benefits for Founders & Early Employees

What you need to know about the 2025 overhaul to maximize your tax savings

A little-known tax incentive intended to spur investment in small businesses can help startup founders, early employees, and investors retain millions of dollars in personal wealth. The incentive, known as Qualified Small Business Stock (QSBS), allows individuals who own shares early enough in a company’s life to avoid taxes on some or all of their gains.

With the passage of “One Big Beautiful Bill Act” (H.R. 1), there are new changes to the policy that make it even more valuable. We previously sat down with Ray Thornson, a Managing Director at Andersen Tax, about what startup shareholders should know about QSBS. He explained the rules and regulations as well as what people can do today to lock in savings later.

What is Qualified Small Business Stock?

Qualified Small Business Stock is a provision in the tax code (U.S. Code Section 1202) that offers tax benefits to individuals who invest in early-stage companies. The provision has been around since 1993, but it gained prominence after changes in 2013 made it significantly more advantageous.

That advantage just grew even larger in 2025. New legislation increased both the benefit amounts and the flexibility of the rules, creating a powerful and timely opportunity for startup investors and employees.

What Are the QSBS Tax Benefits?

There are two main benefits under Section 1202:

- The exclusion

- The rollover provision

If, at the time of acquiring your shares, the company qualifies as a small business and you hold the stock for at least five years, you may be able to exclude a portion (or even all) of the gain upon eventual sale.

For employees, “acquisition” typically means being granted restricted stock or exercising ISO/NSO stock options. For investors, it refers to purchasing shares directly.

What’s Changed Under the 2025 Law?

The new law passed in July 2025 introduced more favorable rules for stock acquired after the enactment date, including:

1. Shorter Holding Periods With Tiered Benefits

Previously, a 100% capital gains exclusion required holding stock for more than 5 years.

Now, the exclusion is tiered based on how long you hold:

| Holding Period | Exclusion Percentage |

| At least 3 years | 50% |

| At least 4 years | 75% |

| At least 5 years | 100% |

This makes QSBS more accessible (albeit at lower exclusion percentages) where previously the five year holding period may not have been met.

2. Higher Gain Exclusion Cap

Under prior law, you could exclude the greater of $10 million or 10x your basis. Now, for stock acquired after July 2025, the cap rises to $15 million or 10x your basis, with inflation adjustments beginning in 2027.

3. Larger Gross Assets Threshold

To qualify as a small business, the company’s assets at the time of acquisition had to be below $50 million. Now, the threshold rises to $75 million, also indexed for inflation starting in 2027 — allowing more companies to qualify.

4. Reduced Alternative Minimum Tax (AMT) Impact

Previously, some of the excluded QSBS gain counted as a preference item under AMT, increasing tax liability. Under the new rules for shares acquired after July 5, 2025, if you claim a 50% or 75% exclusion due to the shorter holding periods, there is no AMT preference related to those gains — further lowering your effective tax burden.

However, the AMT preference still applies to shares acquired before September 28, 2010, even if those shares only qualify for a 50% or 75% exclusion. For those older shares, a portion of the excluded gain remains subject to AMT calculations.

In short, the new law eliminates the AMT penalty for shorter holding periods on newly acquired shares, but older shares (particularly pre-2010) still carry AMT implications.

The History of QSBS

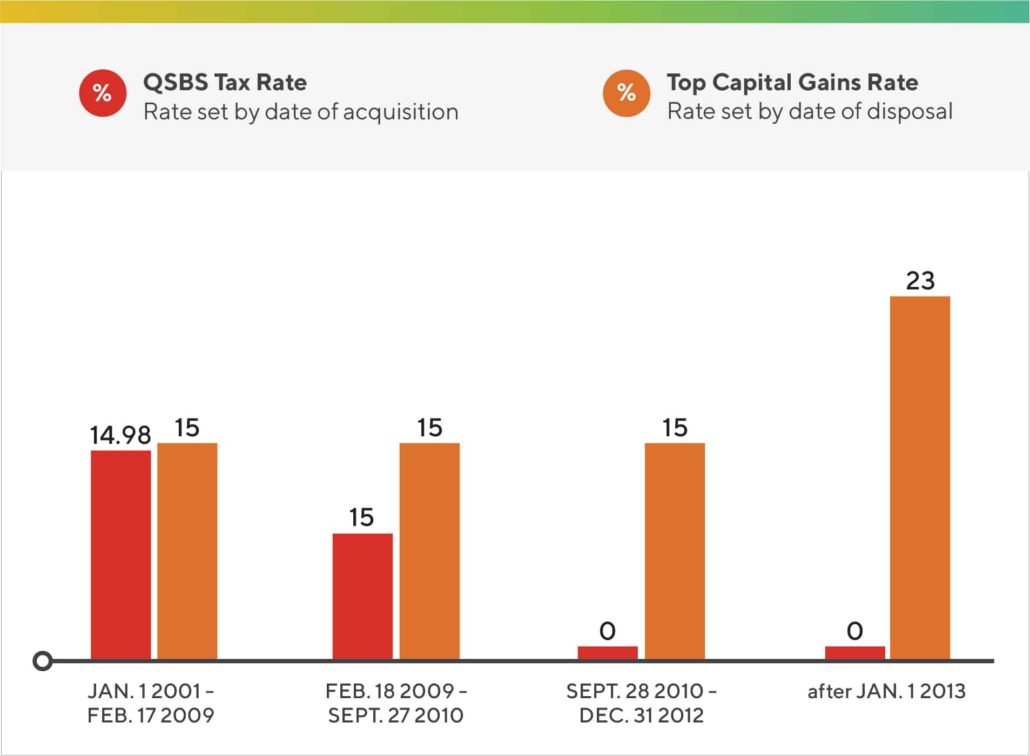

Even before the 2025 changes, QSBS was increasingly attractive:

- The long-term capital gains tax rate rose from 15% to 20% in 2013.

- A 3.8% Medicare surcharge brought the effective rate to 23.8%.

- QSBS exclusion levels increased from 50% to 75% and then 100%.

For stock acquired after September 27, 2010 and before July 5, 2025, if you held it at least five years, you could exclude up to $10M (or 10x basis) of gain tax-free at the federal level.

Now, with higher caps, shorter holding periods, and reduced AMT impact, QSBS provides even more powerful tax savings.

*Includes 3.8% Obamacare surcharge

How To Claim QSBS

1. Asset Threshold

At the time you acquire the stock, the company must have less than $75 million (for stock acquired after July 4, 2025; $50 million if before) in assets.

This includes intellectual property, which is valued differently depending on whether it was developed internally or contributed in exchange for stock.

2. Entity Type Requirements

The company must be a domestic C corporation. S corps and LLCs don’t qualify. You also can’t be incorporated in the Cayman Islands or overseas.

However, if a business begins as an LLC and later converts to a C corp, it can qualify for QSBS from the date of conversion onward.

Certain business types don’t qualify, typically service-heavy sectors like:

- Law and accounting firms

- Hotels and restaurants

- Medical practices

This was done for a couple of reasons. First, to incentivize investors to put their money in small businesses. Secondly, it was really to focus on businesses that — while it’s unclear if we thought in such terms in 1993 — were scalable.

The vast majority of the companies that are formed in the Bay Area will qualify because they tend to revolve around technology and the creation of technology, software, and hardware. These are companies that are very scalable.

FAQs about QSBS with Ray Thornson

Q: If I acquired my options before the company exceeded the asset limit, but exercised them after, do I still qualify?

No. Qualification depends on the company’s assets at the time of exercise (or acquisition for stock grants). Exercising early while the company is still under the limit is advisable.

Q: Are companies adjusting fundraising to stay under the threshold?

Some are. Savvy founders and investors may structure rounds strategically so that QSBS-eligible investors benefit.

Q: What do I need to document to claim QSBS?

Keep a dedicated QSBS file that includes:

- The company’s balance sheet at the time of acquisition

- Proof of C corporation status

- A letter from the company affirming its QSBS eligibility

It could be years before you exclude the gain on your tax return and even longer if you’re audited. By then, you might no longer be involved with the company, which could be much larger and more private, making it hard to access the documents you need. Gather these documents early to put yourself in a good position.

The Takeaway

For startup employees and investors, QSBS has always been a compelling but often-overlooked tax benefit. The 2025 changes make it even more attractive, offering shorter holding periods, higher caps, and AMT relief.

If you believe in your company’s growth potential, consider exercising vested options early and keeping careful records to lock in QSBS benefits. And as always, consult a knowledgeable tax advisor to navigate the complexities and maximize your long-term gains.

Want more growth stage startup insights from peers and experts? Apply to join The Circle.